Introduction to EC Markets Minimum Deposit

The ec markets minimum deposit is an important consideration for traders looking to start their journey in the financial markets. EC Markets, a well-known online trading platform, offers various account types with different minimum deposit requirements to cater to traders of all levels. Understanding these requirements is crucial for making an informed decision about which account type suits your trading needs and financial capabilities.

Understanding EC Markets Account Types and Minimum Deposits

EC Markets provides several account types, each with its own ec markets minimum deposit requirement. These account types are designed to accommodate different trading styles, experience levels, and financial capacities. Here's an overview of the main account types and their corresponding minimum deposits:

| Account Type | Minimum Deposit | Spread From | Commission |

|---|---|---|---|

| Standard Account | $100 | 1.0 pips | No Commission |

| ECN Account | $500 | 0.0 pips | $3.5 per lot |

| Pro Account | $1000 | 0.0 pips | $2.5 per lot |

It's important to note that these ec markets minimum deposit amounts may vary depending on promotions or changes in the broker's policies. Always check the official EC Markets website for the most up-to-date information.

Benefits of Different Account Types

Each account type offered by EC Markets comes with its own set of benefits. Understanding these can help you choose the right account based on your trading goals and the ec markets minimum deposit you're comfortable with:

- Standard Account: Ideal for beginners, with no commission and straightforward pricing

- ECN Account: Suitable for more experienced traders, offering tighter spreads and direct market access

- Pro Account: Designed for professional traders, with the lowest spreads and commissions

The choice of account type not only depends on the ec markets minimum deposit but also on your trading style, experience, and the volume you plan to trade.

Open AccountFactors to Consider When Choosing an Account Type

When deciding on an account type based on the ec markets minimum deposit, consider the following factors:

- Your trading experience level

- The amount of capital you're willing to invest

- Your preferred trading style (day trading, swing trading, etc.)

- The instruments you want to trade

- Your risk tolerance

These factors will help you determine which account type and corresponding ec markets minimum deposit aligns best with your trading goals and financial situation.

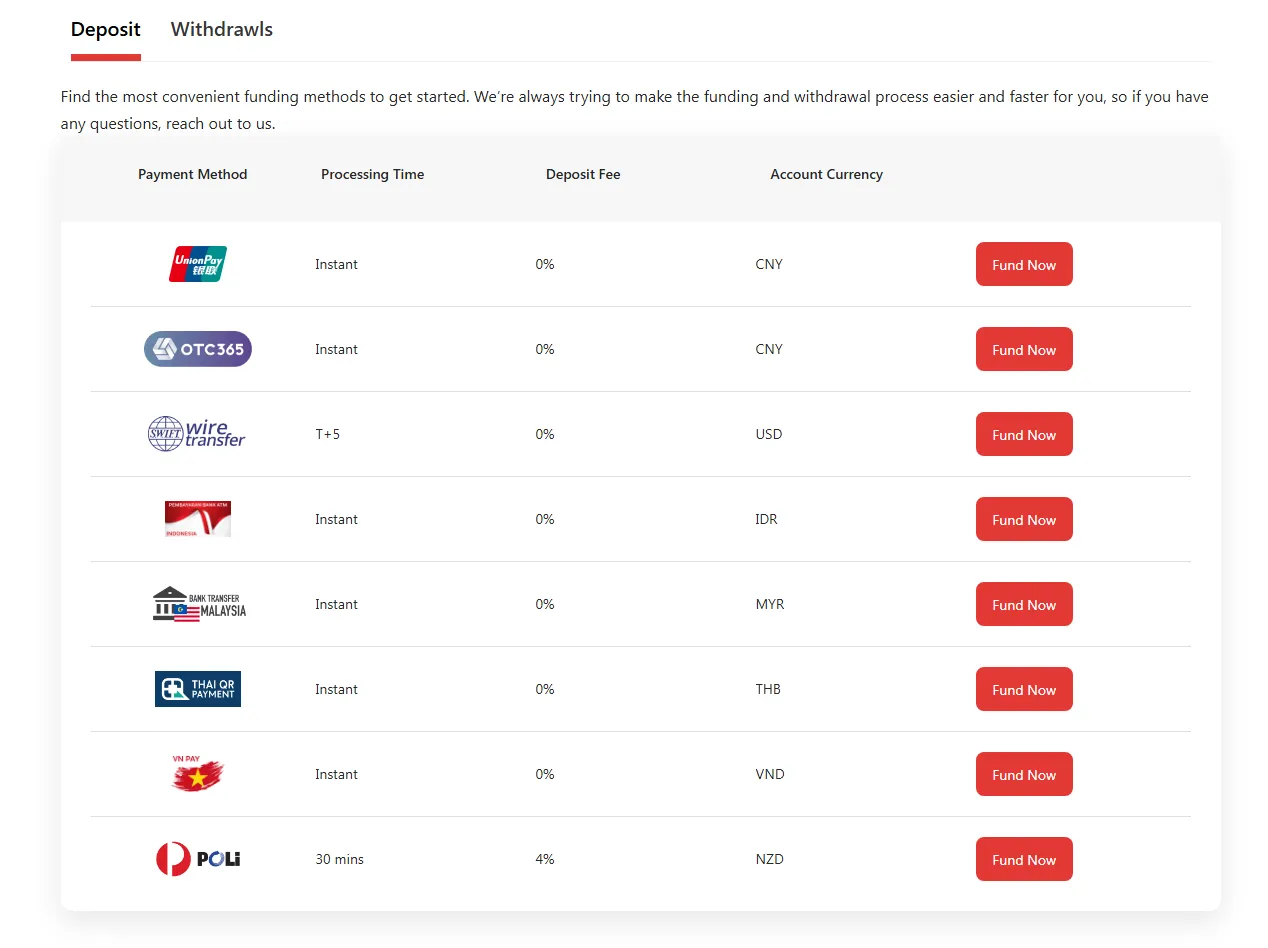

Deposit Methods Available at EC Markets

EC Markets offers various deposit methods to accommodate traders from different regions. The availability of these methods can affect how easily you can meet the ec markets minimum deposit requirement. Here are some common deposit methods:

| Deposit Method | Processing Time | Fees |

|---|---|---|

| Bank Wire Transfer | 1-5 business days | Varies by bank |

| Credit/Debit Cards | Instant | No fees from EC Markets |

| E-wallets (Skrill, Neteller) | Instant | No fees from EC Markets |

It's important to note that while EC Markets may not charge fees for deposits, your bank or e-wallet provider might. Always check with your financial institution about potential fees when making deposits.

Trading Conditions and Leverage

The ec markets minimum deposit is just one aspect of your trading experience. Understanding the trading conditions and leverage offered is equally important. Here's an overview of the trading conditions for different account types:

- Leverage: Up to 1:500 (subject to regulatory restrictions in certain jurisdictions)

- Spreads: Variable, starting from 0.0 pips on ECN and Pro accounts

- Instruments: Forex, CFDs on indices, commodities, and cryptocurrencies

- Minimum trade size: 0.01 lots

Remember that higher leverage can amplify both profits and losses, so it's crucial to use it responsibly, regardless of your account type or initial deposit.

Comparing EC Markets Minimum Deposit with Other Brokers

To put the ec markets minimum deposit in perspective, let's compare it with some other popular brokers in the industry:

| Broker | Minimum Deposit | Account Types |

|---|---|---|

| EC Markets | $100 | Standard, ECN, Pro |

| Broker A | $200 | Standard, Premium |

| Broker B | $50 | Micro, Standard, VIP |

| Broker C | $250 | Silver, Gold, Platinum |

This comparison shows that EC Markets offers a competitive minimum deposit requirement, especially for its Standard account. However, it's important to consider other factors beyond just the minimum deposit when choosing a broker.

Tips for Managing Your Trading Capital

Once you've met the ec markets minimum deposit requirement and opened an account, it's crucial to manage your trading capital effectively. Here are some tips to help you:

- Start with a demo account to practice risk-free

- Only invest what you can afford to lose

- Use proper risk management techniques, such as stop-loss orders

- Diversify your trades across different instruments

- Keep educating yourself about the markets and trading strategies

Following these tips can help you make the most of your initial deposit and potentially grow your trading account over time.

Learn MoreConclusion

The ec markets minimum deposit requirement is an important factor to consider when choosing a trading account. EC Markets offers a range of account types with different minimum deposits to suit various trader profiles. The Standard account, with its $100 minimum deposit, provides an accessible entry point for beginners, while the ECN and Pro accounts cater to more experienced traders with higher capital. When deciding on an account type, it's crucial to consider not just the minimum deposit, but also the trading conditions, leverage, and your own trading goals and experience. Remember that while a lower minimum deposit might seem attractive, it's important to start with an amount you're comfortable with and can afford to risk. Ultimately, successful trading depends not just on your initial deposit, but on your knowledge, strategy, and risk management skills.

Frequently Asked Questions

What is the minimum deposit required to open an account with EC Markets?

The minimum deposit for EC Markets varies depending on the account type. For a Standard account, the minimum deposit is $100. For an ECN account, it's $500, and for a Pro account, it's $1000. However, these amounts may change, so it's always best to check the official EC Markets website for the most current information.

Can I change my account type after making the initial deposit?

Yes, in most cases, you can upgrade your account type after making the initial deposit. For example, if you start with a Standard account and later want to upgrade to an ECN account, you can do so by meeting the minimum deposit requirement for the ECN account. However, it's best to contact EC Markets customer support for specific details on account upgrades.

Are there any fees associated with making a deposit at EC Markets?

EC Markets itself doesn't typically charge fees for deposits. However, your bank or payment provider might charge fees for transactions. It's important to check with your financial institution about any potential fees when making deposits. Also, keep in mind that some deposit methods may have higher minimum deposit requirements than others.